7th July 2021 | Tax

Tax bracket basics

Tax brackets are part of a progressive taxation system, which is used in most developed economies. The basic idea is that as you earn more and reach certain income thresholds, you pay more tax.

But this is where people get confused. Many believe that when you earn enough money to enter a new tax bracket, you will pay a higher rate of tax on all your income.

Instead, tax brackets indicate that different rates of tax apply to different levels of your income.

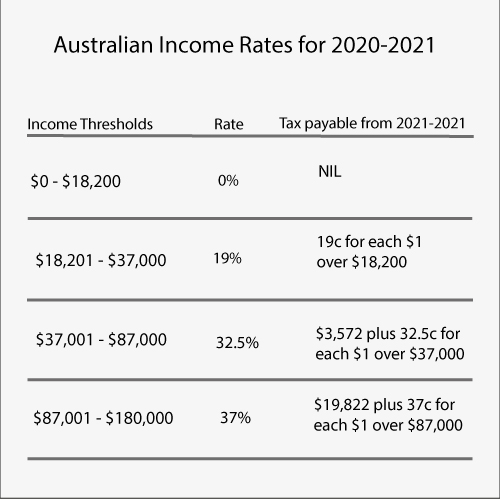

For example, in Australia, the first $18,200 you earn every year isn’t taxed. But once you earn $18,201 or more, you start paying 19 cents per dollar – a tax rate of 19% – until you earn $37,001.

But that doesn’t mean you pay 19% on the entire $37,001. You’ll only pay 19% on the money you earned after the $18,201. So the difference between $18,201 and $37,000 is taxed at 19%.

How Tax Brackets work in practice

What does this mean for someone who gets a pay rise?

Let’s say you’re earning $80,000 a year. At that rate, the first $18,200 of your income isn’t taxed. Then, your income between $18,201 and $37,000 is taxed at 19%; and the income between $37,001 and $80,000 is taxed at $3,572 plus 32.5 cents per dollar.

That means out of your $80,000, you get to keep $60,853 per year – an effective tax rate of 23.9%.

But what happens if your income increases to $90,000 per year? That would put you into the next bracket of more than $87,000, where income is taxed at 37%.

Based on the Australian Tax Office’s (ATO’s) tax brackets, your annual take-home pay would then be $67,268 – with an effective tax rate of 25%. So you take home more even when you move into the next bracket.

Talk to us at Ax3. Where happy to answer any queries you have. Call us on (03) 9995 7261 or email us at info@Ax3.com.au